2023 payroll tax withholding calculator

Payroll withholding calculator 2023 Senin 12 September 2022 Check your National Insurance payroll calculations. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

There are 3 withholding calculators you can use depending on your situation.

. Our Expertise Helps You Make a Difference. Prepare and e-File your. Paycheck after federal tax.

The Tax withheld for individuals calculator is. Customers need to ensure they are calculating their payroll tax correctly. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Subtract 12900 for Married otherwise.

250 and subtract the refund adjust amount from that. Tax withheld for individuals calculator The Tax withheld for individuals calculator is for payments made to. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Partner with Aprio to claim valuable RD tax credits with confidence. This calculator uses the withholding. Tax Withholding Estimator 2022 - 2023.

The standard FUTA tax rate is. Ad Compare This Years Top 5 Free Payroll Software. This online tool guides users through the process of checking their withholding to help determine the right amount to withhold for their personal situation.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Then look at your last paychecks tax withholding amount eg. That result is the tax withholding amount.

Thats where our paycheck calculator comes in. Ad Payroll So Easy You Can Set It Up Run It Yourself. Get Started With ADP Payroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Use this simplified payroll deductions calculator to help you determine your net paycheck.

As the IRS releases 2023 tax guidance we will update this tool. SARS Income Tax Calculator for 2023. Free Unbiased Reviews Top Picks.

Subtract 12900 for Married otherwise. A 2020 or later W4 is required for all new employees. Get Started With ADP Payroll.

For employees withholding is the amount of federal. Paystubs for all jobs. Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Get Started With ADP Payroll. Ad No more forgotten entries inaccurate payroll or broken hearts.

Start the TAXstimator Then select your IRS Tax Return Filing Status. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. See your tax refund estimate.

What You Need Have this ready. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Choose an estimated withholding amount that works for you Results are as accurate as the information you enter.

250 minus 200 50. Start the TAXstimator Then select your IRS Tax Return Filing Status. Time and attendance software with project tracking to help you be more efficient.

Ad The Best HR Payroll Partner For Medium and Small Businesses. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Payroll tax withholding calculator 2023 Senin 19 September 2022 Subtract 12900 for Married otherwise.

Begin tax planning using the 2023 Return Calculator. Take a Guided Tour. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

It takes the federal state and. 2023 Tax Return and Refund Estimator for 2024 The 2023 Calculator on this page is currently based on the latest IRS data. Contact a Taxpert before during or after you prepare and e-File your Returns.

How to calculate annual income. Paycors Tech Saves Time. For example if an employee earns 1500.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Ad Process Payroll Faster Easier With ADP Payroll. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

Ad Process Payroll Faster Easier With ADP Payroll.

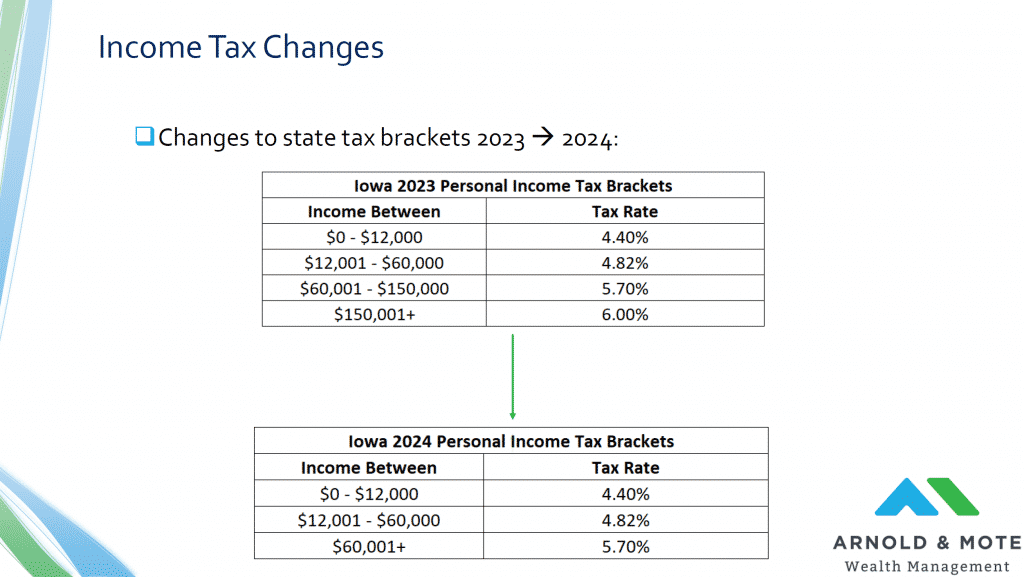

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Social Security What Is The Wage Base For 2023 Gobankingrates

New 2022 Tamil Calendar 2023 Apk In 2022 Tamil Calendar Calendar App Calendar

2022 2023 Tax Brackets Rates For Each Income Level

Retirement Income Connecticut House Democrats

Estimated Income Tax Payments For 2022 And 2023 Pay Online

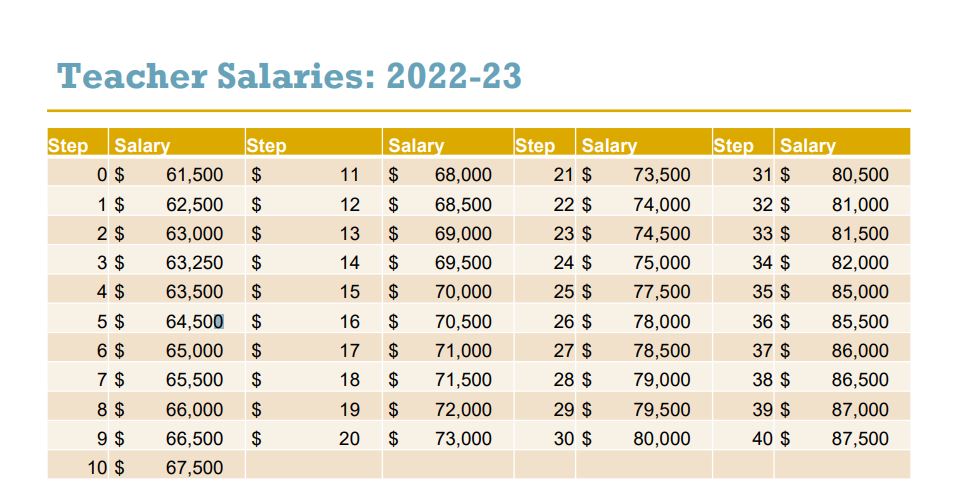

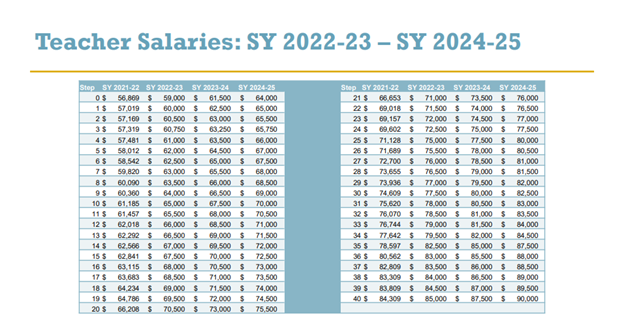

Hisd Trustees Unanimously Approve 2 2 Billion Budget And Highly Competitive Teacher Pay Raises News Blog

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Hisd Announces Teacher Salaries Raises Through 2025 News Blog

Calculator And Estimator For 2023 Returns W 4 During 2022

Comments On New York City S Executive Budget For Fiscal Year 2023 And Financial Plan For Fiscal Years 2022 2026 Office Of The New York City Comptroller Brad Lander

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

2022 Federal Payroll Tax Rates Abacus Payroll