25+ Illinois Payroll Calculator

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

1634 36 W Grace 3804 10 N Marshfield Rentals Chicago Il Rentcafe

3125 Illinois SUTA tax rates for.

. For example if an employee earns 1500 per week the individuals. Ad One intuitive service to manage HR payroll benefits. Ad One intuitive service to manage HR payroll benefits.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. 2x per month. 0625 to 725 Illinois SUTA tax rates for new employers.

All you have to do is enter wage and W-4. Taxes Paid Filed - 100 Guarantee. Make Your Payroll Effortless and Focus on What really Matters.

Ad Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Illinois payroll taxes can be. Heres a step-by-step guide to walk.

How do I calculate salary to hourly wage. Ad Compare Prices Find the Best Rates for Payroll Services. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Latest payroll taxes rates related laws for the state of Illinois. The following points apply to Illinois payroll taxes. Ad Run Payroll Faster Easier With Run Powered By ADP.

Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Employees cost a lot more than their salary.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Illinois. Amount Equivalent to 30x the Federal Minimum Wage of 725 based on your pay frequency Weekly or less 21750. Theres a new bar for HR.

It can also be used to help fill steps 3 and 4 of a W-4 form. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. Easy 247 Online Access.

52000 52 payrolls 1000 gross pay If this employees pay frequency is semi-monthly the calculation is. The maximum an employee will pay in 2022 is 911400. Then multiply that number by the total number of weeks in a year 52.

In addition he is the basketball coach and earns 2000. There is a flat rate of taxation on net income which is 495 Illinois payroll taxes are exempted for the employees who are non-residents. Ad Learn How Papaya Can Help You Comply with Local Labor Laws.

Open an Account Earn 14x the National Average. Illinois payroll tax calculator info for business owners and payrollHR managers. Discover ADP Payroll Benefits Insurance Time Talent HR More.

52000 24 payrolls. Multiply the hourly wage by the number of hours worked per week. Get Gusto the all-in-one HR platform for growing businesses.

Theres a new bar for HR. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. At District B the teachers pay their own 90 percent retirement contributions.

Get Gusto the all-in-one HR platform for growing businesses. Record Requests. Well do the math for youall you need to do is enter.

Our employee cost calculator shows you how much they cost after taxes benefits other factors are added up. Every other week 43500. 2016-17 - A teacher has a base contract of 33000.

Illinois SUTA wage base limit for 2020. Simply enter their federal and state W-4 information as. Employer Payroll Tax Calculator One simple tool can estimate your tax deductions and withholdings making payroll processing accurate quick and easy.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Get 3 Months Free Payroll. If this employees pay frequency is weekly the calculation is.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. 12740 Illinois SUTA tax rates for 2020. The University Payroll Benefits UPB office facilitates accurate timely payment and benefits enrollment of employees on each of the three universities.

Illinois Secure Choice Employer Information

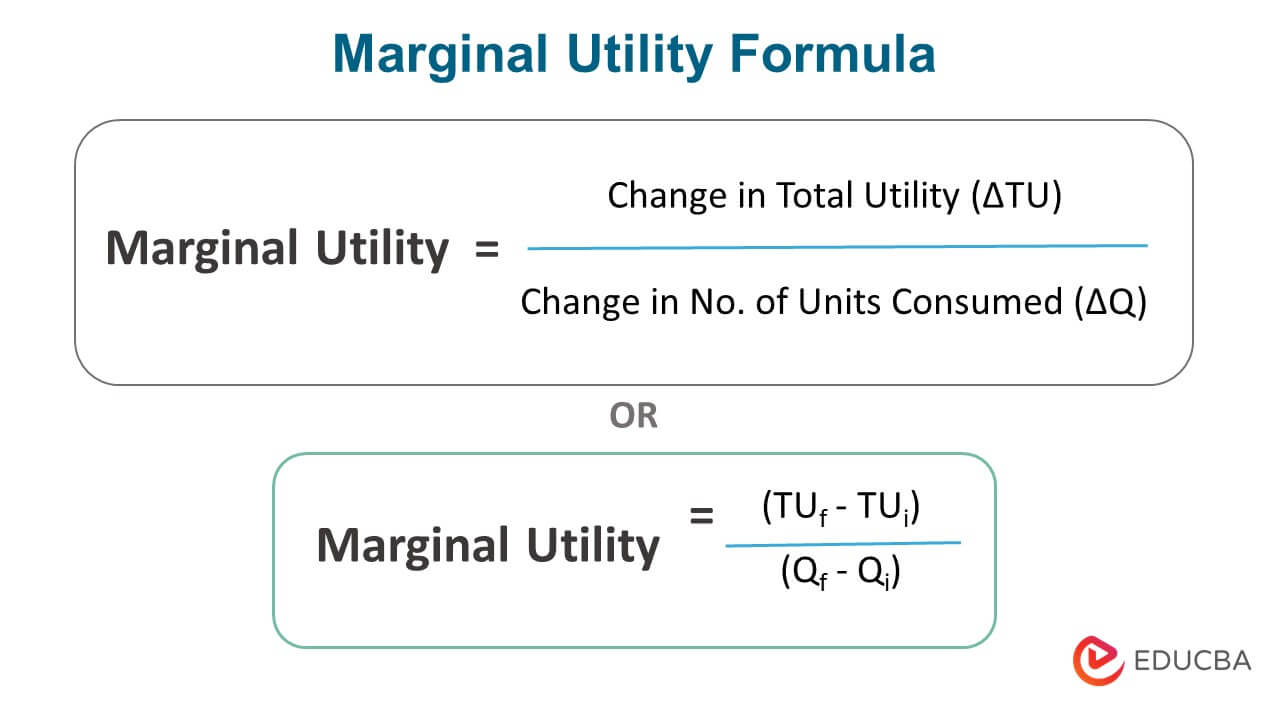

Marginal Utility Formula Calculator Example With Excel Template

Illinois Paycheck Calculator Smartasset

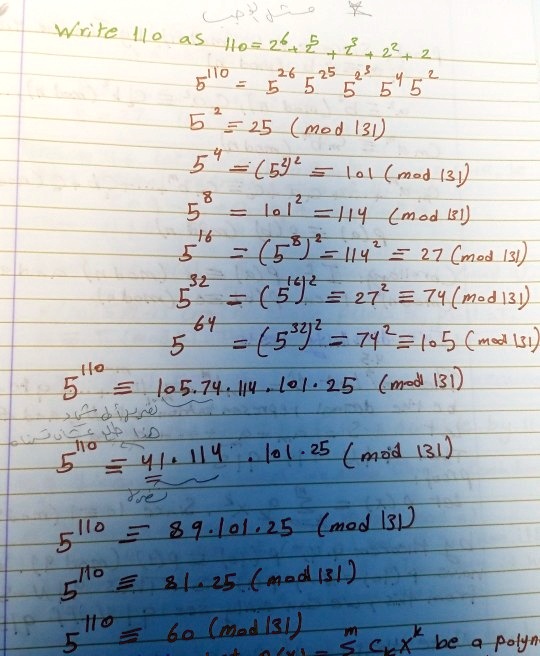

Solved Write Il 0 Aio 26 8 8 22 5 0 526 525 52 5 5 52 5 25 Med1g1 54 594 O L Med 21 Lol2 U4 Cmedki 5 5 44 3 27

Illinois Paycheck Calculator 2022 2023

Star Trek Adventskalender 25 Tage Bis Weihnachten Etsy De

Characteristics Of Minimum Wage Workers 2020 Bls Reports U S Bureau Of Labor Statistics

Beacon Hill Great Oaks Apartments 5203 Linden Rd Unit 2115 Rockford Il Rentcafe

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

The Fladler Building Apartments 1918 1920 Harrison St Evanston Il Rentcafe

15 Victoria Ln East Falmouth Ma 02536 Realtor Com

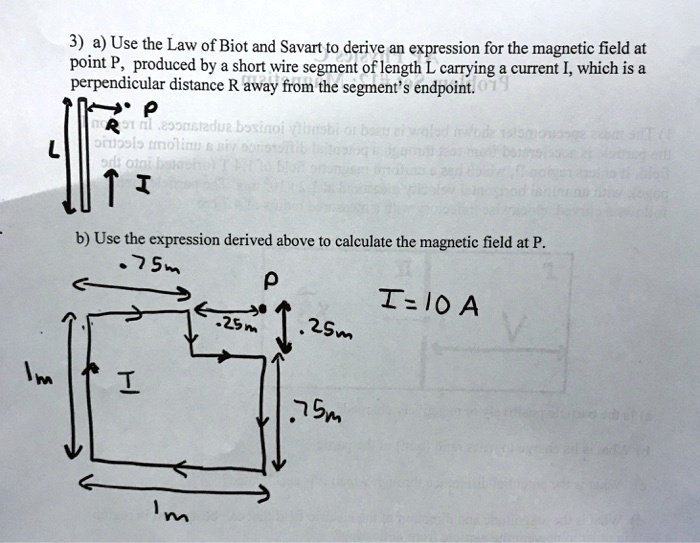

Solved 3 Use The Law Of Biot And Savart To Derive An Expression For The Magnetic Field At Point P Produced By A Short Wire Segment Of Length L Carrying Current

How Assembly Bill 5 Differs From Proposition 22

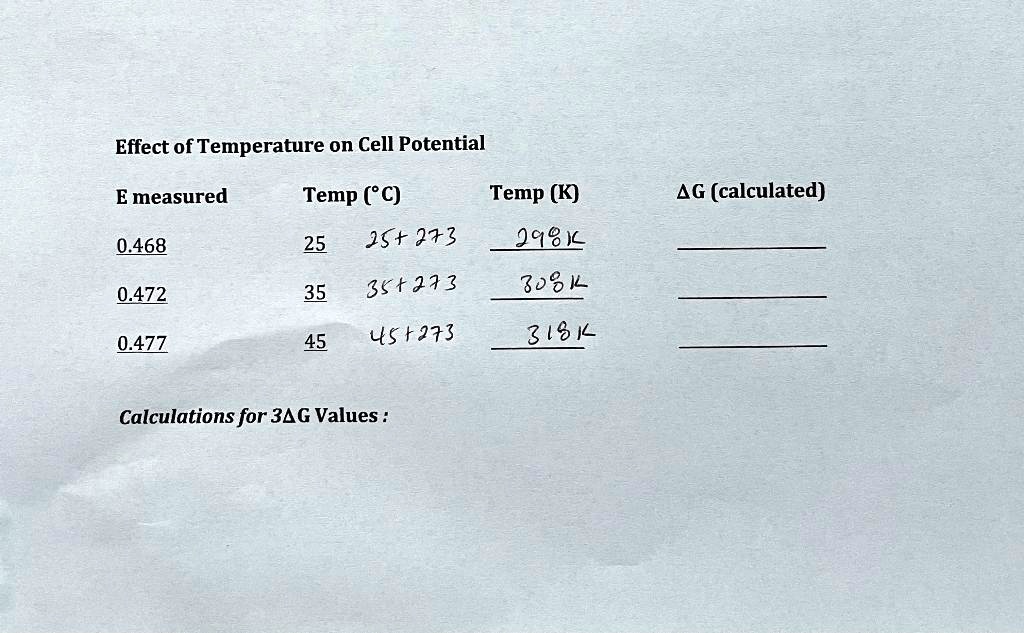

Solved Effect Of Temperature On Cell Potential E Measured Temp Pc Temp K 25 25 273 1981 35 35 29 3 3091 45 45 233 319 1 Ag Calculated 0 468 0472 0 477 Calculations For 34g Values

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Illinois County Well Being Dashboard Heartland Alliance

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Paycheck Calculator Take Home Pay Calculator